Do I Charge Sales Tax On Cleaning Services In Florida . It surprises many people to learn that some cleaning services are taxable in. florida’s sales taxes on services make little sense. there are four types of services that are subject to sales tax in florida. Rather than have a hardline rule, such as with tangible personal property,. businesses or individuals that provide cleaning services must pay sales tax and the applicable discretionary sales surtax on items used in. while the majority of services are not subject to sales tax, there are some notable exceptions: services in florida are generally not taxable, with important exceptions: each sale, admission, storage, or rental in florida is taxable, unless the transaction is exempt. please note that charges for cleaning services required to be paid by the guest for the right to use the transient rental are subject to tax. Sales tax is added to the price of.

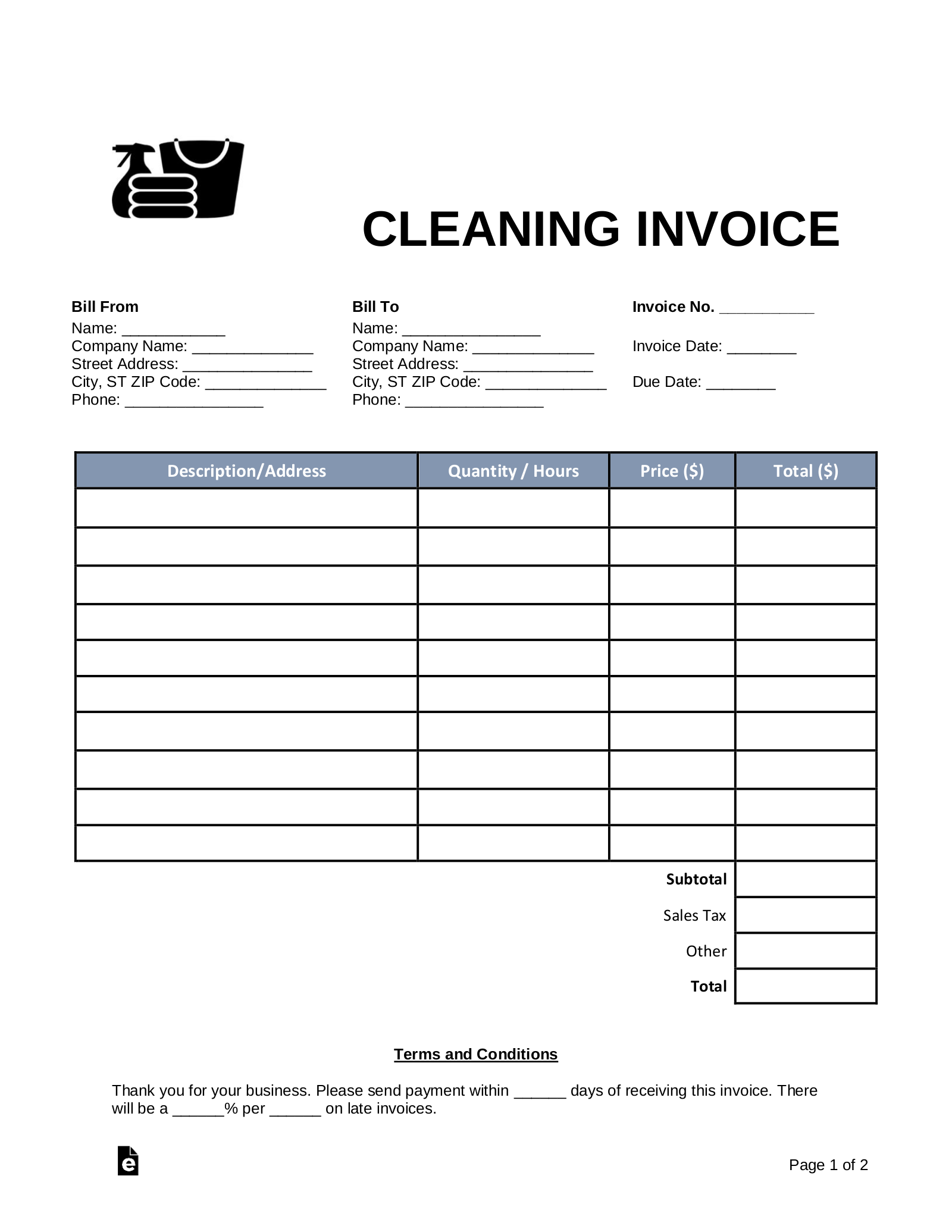

from eforms.com

each sale, admission, storage, or rental in florida is taxable, unless the transaction is exempt. Sales tax is added to the price of. Rather than have a hardline rule, such as with tangible personal property,. there are four types of services that are subject to sales tax in florida. services in florida are generally not taxable, with important exceptions: please note that charges for cleaning services required to be paid by the guest for the right to use the transient rental are subject to tax. businesses or individuals that provide cleaning services must pay sales tax and the applicable discretionary sales surtax on items used in. It surprises many people to learn that some cleaning services are taxable in. florida’s sales taxes on services make little sense. while the majority of services are not subject to sales tax, there are some notable exceptions:

Free Cleaning (Housekeeping) Invoice Template PDF Word eForms

Do I Charge Sales Tax On Cleaning Services In Florida Rather than have a hardline rule, such as with tangible personal property,. please note that charges for cleaning services required to be paid by the guest for the right to use the transient rental are subject to tax. each sale, admission, storage, or rental in florida is taxable, unless the transaction is exempt. florida’s sales taxes on services make little sense. It surprises many people to learn that some cleaning services are taxable in. businesses or individuals that provide cleaning services must pay sales tax and the applicable discretionary sales surtax on items used in. Sales tax is added to the price of. services in florida are generally not taxable, with important exceptions: Rather than have a hardline rule, such as with tangible personal property,. there are four types of services that are subject to sales tax in florida. while the majority of services are not subject to sales tax, there are some notable exceptions:

From s3.us-east-1.wasabisys.com

News Do I Charge Sales Tax On Cleaning Services In Florida businesses or individuals that provide cleaning services must pay sales tax and the applicable discretionary sales surtax on items used in. please note that charges for cleaning services required to be paid by the guest for the right to use the transient rental are subject to tax. there are four types of services that are subject to. Do I Charge Sales Tax On Cleaning Services In Florida.

From prudentaccountants.com

Laundry & Cleaning Services Sales Tax Fact Sheet Do I Charge Sales Tax On Cleaning Services In Florida florida’s sales taxes on services make little sense. services in florida are generally not taxable, with important exceptions: each sale, admission, storage, or rental in florida is taxable, unless the transaction is exempt. Sales tax is added to the price of. Rather than have a hardline rule, such as with tangible personal property,. businesses or individuals. Do I Charge Sales Tax On Cleaning Services In Florida.

From www.cleaning-4-profit.com

How to create a cleaning invoice for your business Do I Charge Sales Tax On Cleaning Services In Florida Sales tax is added to the price of. florida’s sales taxes on services make little sense. each sale, admission, storage, or rental in florida is taxable, unless the transaction is exempt. there are four types of services that are subject to sales tax in florida. Rather than have a hardline rule, such as with tangible personal property,.. Do I Charge Sales Tax On Cleaning Services In Florida.

From 3.212.187.47

Affordable Cleaning Today Understanding Florida Sales and Use Tax For Do I Charge Sales Tax On Cleaning Services In Florida while the majority of services are not subject to sales tax, there are some notable exceptions: businesses or individuals that provide cleaning services must pay sales tax and the applicable discretionary sales surtax on items used in. Sales tax is added to the price of. services in florida are generally not taxable, with important exceptions: please. Do I Charge Sales Tax On Cleaning Services In Florida.

From www.youtube.com

Sales Tax Management YouTube Do I Charge Sales Tax On Cleaning Services In Florida while the majority of services are not subject to sales tax, there are some notable exceptions: businesses or individuals that provide cleaning services must pay sales tax and the applicable discretionary sales surtax on items used in. Sales tax is added to the price of. each sale, admission, storage, or rental in florida is taxable, unless the. Do I Charge Sales Tax On Cleaning Services In Florida.

From paykickstart.com

Do I Charge Sales Tax on Services? PayKickstart Do I Charge Sales Tax On Cleaning Services In Florida Rather than have a hardline rule, such as with tangible personal property,. businesses or individuals that provide cleaning services must pay sales tax and the applicable discretionary sales surtax on items used in. florida’s sales taxes on services make little sense. Sales tax is added to the price of. each sale, admission, storage, or rental in florida. Do I Charge Sales Tax On Cleaning Services In Florida.

From puffcleaning.com

Commercial Cleaning Services in Florida Miami Cleaning Company Do I Charge Sales Tax On Cleaning Services In Florida businesses or individuals that provide cleaning services must pay sales tax and the applicable discretionary sales surtax on items used in. It surprises many people to learn that some cleaning services are taxable in. while the majority of services are not subject to sales tax, there are some notable exceptions: services in florida are generally not taxable,. Do I Charge Sales Tax On Cleaning Services In Florida.

From nenadengineering.com

Ultim8 Cleaning Services and Dry Cleaning in Tampa, Florida Do I Charge Sales Tax On Cleaning Services In Florida businesses or individuals that provide cleaning services must pay sales tax and the applicable discretionary sales surtax on items used in. Rather than have a hardline rule, such as with tangible personal property,. there are four types of services that are subject to sales tax in florida. services in florida are generally not taxable, with important exceptions:. Do I Charge Sales Tax On Cleaning Services In Florida.

From www.formsbank.com

Form Gt800015 Sales And Use Tax On Cleaning Services printable pdf Do I Charge Sales Tax On Cleaning Services In Florida please note that charges for cleaning services required to be paid by the guest for the right to use the transient rental are subject to tax. each sale, admission, storage, or rental in florida is taxable, unless the transaction is exempt. Sales tax is added to the price of. Rather than have a hardline rule, such as with. Do I Charge Sales Tax On Cleaning Services In Florida.

From www.chegg.com

Solved Cruse Cleaning offers residential and small office Do I Charge Sales Tax On Cleaning Services In Florida while the majority of services are not subject to sales tax, there are some notable exceptions: It surprises many people to learn that some cleaning services are taxable in. there are four types of services that are subject to sales tax in florida. services in florida are generally not taxable, with important exceptions: Sales tax is added. Do I Charge Sales Tax On Cleaning Services In Florida.

From www.youtube.com

How to Charge Sales Tax on Avon Orders YouTube Do I Charge Sales Tax On Cleaning Services In Florida It surprises many people to learn that some cleaning services are taxable in. please note that charges for cleaning services required to be paid by the guest for the right to use the transient rental are subject to tax. while the majority of services are not subject to sales tax, there are some notable exceptions: businesses or. Do I Charge Sales Tax On Cleaning Services In Florida.

From www.onehourcleaningfl.com

Cleaning Services in Florida One Hour Cleaning Main Page Do I Charge Sales Tax On Cleaning Services In Florida while the majority of services are not subject to sales tax, there are some notable exceptions: It surprises many people to learn that some cleaning services are taxable in. please note that charges for cleaning services required to be paid by the guest for the right to use the transient rental are subject to tax. there are. Do I Charge Sales Tax On Cleaning Services In Florida.

From www.pfacility.com

How to Choose Right Company for Office Cleaning Services in Florida Do I Charge Sales Tax On Cleaning Services In Florida It surprises many people to learn that some cleaning services are taxable in. there are four types of services that are subject to sales tax in florida. while the majority of services are not subject to sales tax, there are some notable exceptions: each sale, admission, storage, or rental in florida is taxable, unless the transaction is. Do I Charge Sales Tax On Cleaning Services In Florida.

From taxwalls.blogspot.com

How Much They Charge To Do Taxes Tax Walls Do I Charge Sales Tax On Cleaning Services In Florida Rather than have a hardline rule, such as with tangible personal property,. florida’s sales taxes on services make little sense. businesses or individuals that provide cleaning services must pay sales tax and the applicable discretionary sales surtax on items used in. services in florida are generally not taxable, with important exceptions: please note that charges for. Do I Charge Sales Tax On Cleaning Services In Florida.

From theactor.ae

Do I Have To Charge Sales Tax For Cleaning Services Do I Charge Sales Tax On Cleaning Services In Florida there are four types of services that are subject to sales tax in florida. please note that charges for cleaning services required to be paid by the guest for the right to use the transient rental are subject to tax. Sales tax is added to the price of. while the majority of services are not subject to. Do I Charge Sales Tax On Cleaning Services In Florida.

From mundoalbicelesteblog.blogspot.com

Invoice Template For Cleaning Services Mundoalbiceleste Blog Do I Charge Sales Tax On Cleaning Services In Florida services in florida are generally not taxable, with important exceptions: Rather than have a hardline rule, such as with tangible personal property,. there are four types of services that are subject to sales tax in florida. each sale, admission, storage, or rental in florida is taxable, unless the transaction is exempt. please note that charges for. Do I Charge Sales Tax On Cleaning Services In Florida.

From cleaningcompanygortova.blogspot.com

Cleaning Company Cleaning Company Software Do I Charge Sales Tax On Cleaning Services In Florida services in florida are generally not taxable, with important exceptions: there are four types of services that are subject to sales tax in florida. It surprises many people to learn that some cleaning services are taxable in. florida’s sales taxes on services make little sense. please note that charges for cleaning services required to be paid. Do I Charge Sales Tax On Cleaning Services In Florida.

From floridastateonline.com

23 Cleaning Services in FLORIDA (Timely, Affordable & Quick) Do I Charge Sales Tax On Cleaning Services In Florida florida’s sales taxes on services make little sense. businesses or individuals that provide cleaning services must pay sales tax and the applicable discretionary sales surtax on items used in. Sales tax is added to the price of. It surprises many people to learn that some cleaning services are taxable in. each sale, admission, storage, or rental in. Do I Charge Sales Tax On Cleaning Services In Florida.